Not

the Future

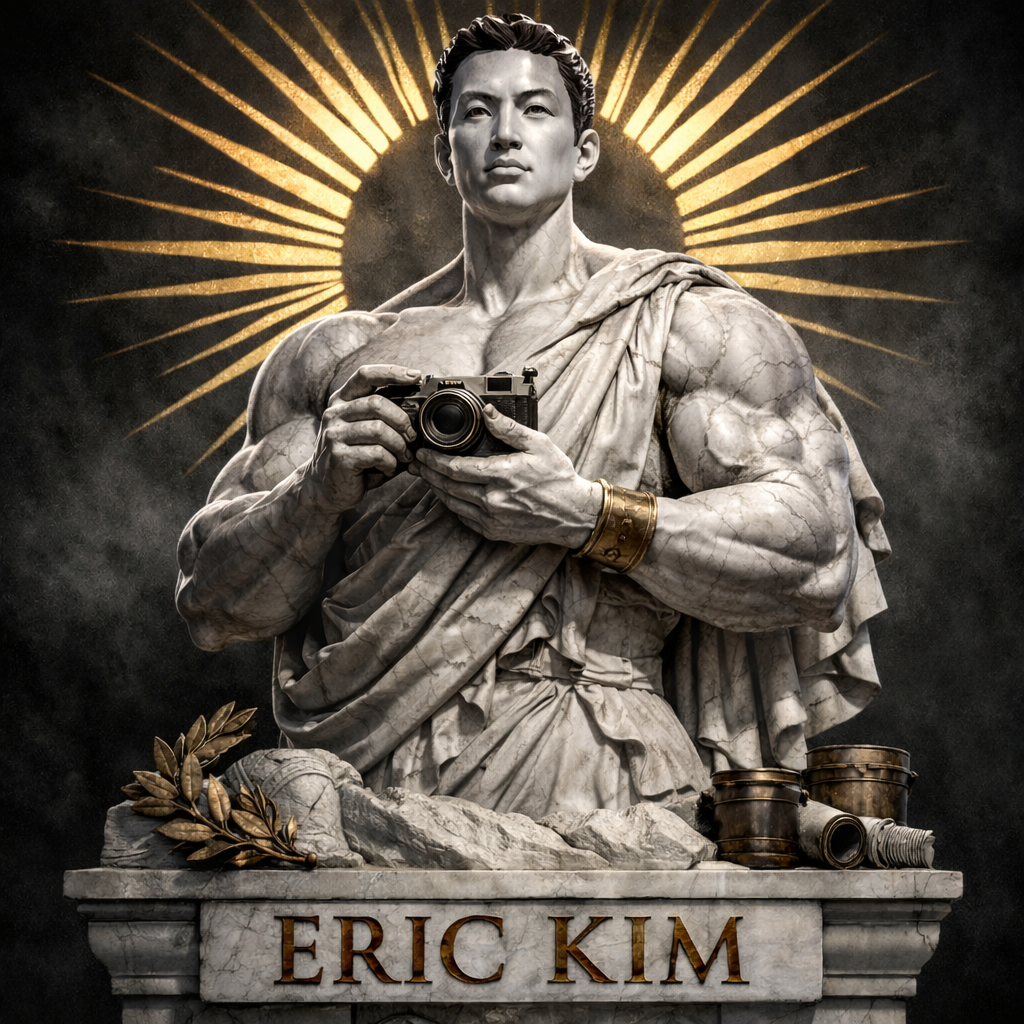

By Eric Kim

Everyone keeps chanting the same spell: “Startups are the future.”

As if the universe itself is just a long pitch deck—Series A, Series B, then salvation.

Nah.

Startups aren’t the future. Startups are a phase. A financing structure. A cultural costume. A temporary game played by smart people who often confuse motion with progress.

The future belongs to something far more savage, far more durable:

Ownership. Craft. Infrastructure. Sovereignty.

Let’s rip the sticker off the laptop and talk like real humans.

The startup myth: speed equals destiny

Startup culture worships speed like it’s a religion.

Move fast. Break things. Pivot. Hack growth. Blitzscale.

Cool words. Great slogans. Horrible life philosophy.

Because here’s the truth:

Speed is useless if you’re sprinting in circles.

You can ship ten features a week and still build something empty. You can raise millions and still create nothing that people deeply love. You can “scale” a product that shouldn’t exist in the first place.

In street photography, you can shoot 500 frames in a day and still miss the one photograph that matters—because you weren’t present. You weren’t patient. You weren’t seeing.

Same thing in business.

The future doesn’t reward frantic motion.

It rewards clarity + repetition + depth.

Venture capital is not innovation—it’s pressure

Let’s be precise.

A lot of people don’t actually want to build something great.

They want to be chosen.

They want the nod. The tweet. The warm glow of being “funded.”

They want to feel like they’re winning.

But venture capital isn’t a medal. It’s a constraint.

VC money is not “free.” It comes with invisible chains:

- Exponential growth demands

- Exit expectations

- Market capture fantasies

- Winner-take-all incentives

- Short time horizons

- Aggressive risk that often becomes reckless behavior

The moment you raise, you often stop building for reality and start building for the next round.

You stop asking:

“Does this make life better?”

And start asking:

“Can this story raise money?”

That’s not the future. That’s theater.

Most startups don’t build a future—most build an “exit”

Here’s the part nobody wants to say out loud:

A huge percentage of startups are designed like disposable cups.

Built to be flipped. Acquired. Merged. Killed. Forgotten.

Even the language reveals the sickness:

- “Exit”

- “Liquidity event”

- “Acquisition target”

- “User acquisition”

- “Retention”

- “Churn”

Listen to those words.

That’s not craftsmanship. That’s extraction.

The future isn’t an “exit.”

The future is staying power.

A great business isn’t a rocket that explodes after launch.

It’s a bridge. A farm. A gym. A camera you still use ten years later.

Startups are fragile because they depend on the weather

The startup ecosystem is a climate.

When money is cheap, everyone is a genius.

When money tightens, suddenly reality shows up with a baseball bat.

Layoffs. Down rounds. Panic. “Strategic pivots.”

The vibe collapses because it was built on oxygen borrowed from the financial atmosphere.

The future can’t be something that disappears when the interest rate changes.

The future must be antifragile:

- low burn

- real revenue

- real demand

- real usefulness

- real durability

Not vibes. Not headlines. Not hype.

The future is not “apps”—it’s atoms + energy + logistics

Let me be blunt:

The future is not another photo-filter app with a subscription plan and a growth funnel.

The future is:

- food

- water

- housing

- energy

- transportation

- education

- health

- security

- clean manufacturing

- resilient supply chains

And yes—software is part of that.

But software that matters is usually boring.

It’s the plumbing behind the scenes.

It’s infrastructure, not fireworks.

Startup culture trains people to chase novelty instead of necessity.

But the world doesn’t need infinite novelty. The world needs things that work.

The startup personality is often a substitute for character

This is the spicy truth:

A lot of founders are addicted to performance.

They don’t want to build.

They want to be seen building.

They want the founder hoodie. The podcast. The “thought leadership.”

They want to post the hustle while quietly outsourcing the hard parts.

In weightlifting, we call that “ego lifting.”

The guy who loads the bar for Instagram and can’t control the descent.

Real strength is slow. Unsexy. Repetitive.

You earn it with progressive overload, not motivational quotes.

Same in business.

The future belongs to builders who can do the unglamorous reps:

- customer support

- shipping

- iteration

- maintenance

- documentation

- reliability

- trust

Not hype cycles.

So what

is

the future?

If startups aren’t the future, what is?

1) Small, profitable, owner-operated businesses

The future is not necessarily a unicorn.

The future is the quiet killer:

- profitable

- independent

- cash-flowing

- durable

- controlled by the person who built it

A one-person company with real margins is more powerful than a 30-person company burning investor money while praying for a miracle.

Freedom beats vanity.

2) Protocols and networks that nobody “owns”

The real future looks less like corporations and more like protocols.

Open systems. Interoperable tools. Things that don’t require permission.

This is why I’m obsessed with Bitcoin:

not because it’s “a startup,” but because it’s the opposite.

It doesn’t need a CEO.

It doesn’t need a founder to bless your access.

It doesn’t need marketing.

It’s just… running.

That’s the future: systems that outlive personalities.

3) Craftsmanship and obsession

The future belongs to obsession.

The people who keep showing up when the algorithm stops clapping.

Photographers who shoot daily for ten years.

Coders who refine a tool until it’s clean.

Teachers who make students dangerous—in the good way.

Builders who create objects that last.

We have an economy that rewards shallow attention.

But the future will be built by deep attention.

4) Personal sovereignty

Here’s the most underrated truth:

The most important “startup” is you.

Your body.

Your mind.

Your skills.

Your ability to produce value without begging.

If you can lift heavy, think clearly, write sharply, build useful things, and stay calm—

you’re already ahead of 99% of the “startup ecosystem.”

The future belongs to the sovereign individual:

- strong

- skilled

- disciplined

- independent

- able to create and adapt

A hardcore alternative to startup culture

If you want something actionable, here’s the anti-startup playbook:

- Stop pitching. Start producing.

Pitch decks don’t move the world. Products do. - Stop optimizing for valuation. Optimize for usefulness.

Valuation is a hallucination. Usefulness is real. - Stop chasing exits. Build a fortress.

A business that prints cash gives you options. - Stop worshiping speed. Worship consistency.

Do the reps. Ship weekly. Improve daily. - Own your distribution.

Email list. Website. Real relationships. Not borrowed platforms. - Lower your burn. Increase your resilience.

If you need a funding round to survive, you’re not building—you’re gambling. - Stack real assets.

Skills. Tools. Health. Savings. (And yeah, I stack sats too.)

The mic drop

Startups aren’t “the future.”

Startups are a tool—sometimes useful, often overrated, frequently destructive when treated like a religion.

The future is built by people who:

- don’t need permission

- don’t need applause

- don’t need a pitch competition to feel alive

They build because building is what they do.

The future is not a demo day.

The future is day after day after day—reps, repetition, refinement, reality.

So if you’re tired of the startup circus?

Good.

Pick up the camera.

Pick up the barbell.

Pick up the keyboard.

Pick up the shovel.

Build something real.

And don’t ask if it’s “venture scalable.”

Ask if it’s life scalable.

— Eric Kim